In most states (there’s at least one exception), the history of a “blue title” vehicle gives buyers pause, but it can also offer opportunity. When a car suffers significant damage and insurance declares it a total loss, the rebuilt vehicle still carries a permanent title brand – a blue title.

This piece of paper carries a history of accidents, floods or wrecks. But for informed buyers, a blue title can provide value and allow them to purchase a vehicle they wouldn’t otherwise afford. Should you consider a blue title vehicle? And in which state is a “blue title” actually a good thing?

What is a Blue Title?

A blue title often refers to the legal document that certifies the ownership of a vehicle. In most states, a blue title is associated with a salvage vehicle, which is one that has been damaged and then repaired to a condition that is considered safe to operate.

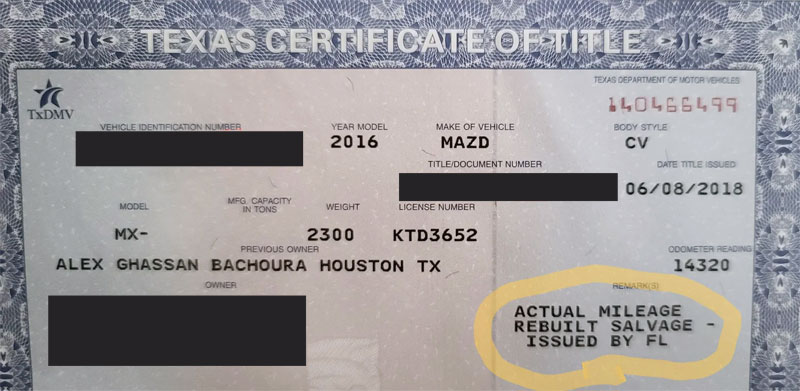

However, Texas is the exception to this rule.

In Texas, a blue title, also known as a “clean title,” signifies that a vehicle is in good condition with a clear history, as opposed to a salvage vehicle. This means that the vehicle has not been significantly damaged or undergone major repairs due to accidents, floods, or other events that could affect its structural integrity and safety.

The term “blue title” can cause confusion because in Texas, it represents a vehicle without any major issues, which is contrary to what it may signify in other regions.

It’s important to note that a blue title stamped with “salvage” in Texas means the vehicle has been repaired and meets all Department of Motor Vehicles (DMV) requirements to be deemed safe for operation again. However, this is not the standard blue title but a specific case where a previously salvaged vehicle has been restored to a roadworthy condition.

Because not all states define a blue title the same way, it’s always best to check with your local DMV office for the correct meaning of “blue title” in your state.

How a Vehicle Gets a Blue Title

For a vehicle to end up with a blue branded title, it first needs to be declared a total loss by an insurance company.

This usually happens after an accident when the estimated repair costs exceed a certain percentage of the car’s pre-accident value, generally around 75-80%. With the repairs not deemed cost-effective, the insurer “totals” the vehicle and pays out the cash value to the owner.

The insurance company then obtains the damaged vehicle’s title and typically auctions it off (or allows the owner to buy it back at a reduced price).

Buyers at these auctions include auto parts companies, scrap metal dealers, and individual vehicle rebuilders or investors looking for fixable cars. If the car is salvageable, the new owner will acquire the necessary parts and complete structural repairs to get the car roadworthy again.

Once repairs are finished, the rebuilder submits an application to the Department of Motor Vehicles for a rebuilt or salvage title. The DMV inspects the vehicle to verify repairs were properly done. If inspection is passed, the car is issued a new title, but now with a permanent brand indicating its rebuilding history.

This branded blue title replaces the original clean title, following the car for its lifetime. The process serves to notify all future owners that substantial damage occurred at some point even after repairs were made. Certain states may also require ongoing safety inspections to keep a blue title car registered.

What a Blue Title Affects

While a blue title car may appear normal after repairs, its branding can still carry important ownership implications.

Lower Resale Value

Vehicles with branded titles can have resale values 50% or more below average market prices. Stigma around damage histories and rebuilt components outweigh even perfect mechanical condition.

Dealers also offer far less on trade-ins due to the title status. This major impact can make blue title cars more difficult to sell to private parties.

The reason why a vehicle was rebuilt in the first place also plays a role on resale value. For example, a vehicle that has suffered frame damage or extensive structural damage in an accident is likely to be devalued more than one that had more cosmetic damage because potential buyers may be concerned about the integrity and safety of the vehicle.

Similarly, cars that have been flooded often have a range of potential electrical and mechanical issues that can manifest over time, making them less desirable and thus further decreasing their resale value.

Higher Insurance Costs

Auto insurers view branded cars as higher risk, so policies have premium markups around 10-40% above average rates.

Some insurers outright deny coverage availability if collision or comprehensive is required. Others impose restrictive policy limits on claim payouts for such vehicles. There’s also the risk that post-claim investigations scrutinize pre-existing repairs from total loss events.

Limited Financing Options

The vast majority of banks and lenders shy away from funding vehicles with branded titles given concerns of excessive risk and low collateral value.

Some credit unions or subprime lenders may provide financing, often at double-digit interest rates, if credit scores are strong. Otherwise, paying cash may be the only option.

Registration/Inspection Challenges

States can enforce laws requiring specific ongoing safety or emissions testing for title branded vehicles before renewing registrations annually. These inspections frequently lead to headaches and paperwork if repairs trigger check engine lights or something minor is detected.

There’s always a risk that failing just one test could mean license plates get revoked and render the vehicle undriveable. The permanence and severity of these potential impacts make proper evaluation of any blue title purchase a must.

Should You Consider a Blue Title Car?

Whether buying a car with a branded title makes sense comes down to your personal tolerance for risk versus potential reward.

The savings over the same vehicle with a clean title can be substantial, often 30-50%. This appeals if you’ve always dreamed of owning a certain luxury model or something rare. Just know that problems can sneak through even the best inspections.

Additionally, you may deal with higher registration costs and insurance premiums, and most likely need to pay cash as financing options are limited. These long-term costs chip away at any original discount.

You also must consider how long you plan to own the vehicle. Short term ownership magnifies risks around repair costs or accidents affecting resale value. Those comfortable holding onto cars for many years may mitigate branded impacts over time.

In the end, branded title vehicles reward the hyper diligent buyer who researches service history, has trustworthy mechanics or DIY repair skills, understands title brands, reviews large vehicle inspection checklists, and is wary of anything suspicious hiding subpar rebuild work. Others may wish to avoid the uncertainty when vehicle history matters most.

Blue Title Buying Tips

If you’re considering a blue title vehicle, either for financial savings or access to a model you normally couldn’t afford, there are some important best practices to follow:

- Get a pre-purchase inspection by a trusted mechanic. Have them put the vehicle on a lift and thoroughly inspect it for body work quality, frame damage, computer codes, wiring condition, and other component functionality. This catches any corners cut on repairs or ongoing issues.

- Test drive and pay attention to signs of problems. Listen for noises, grinding, vibrations, pulling in either direction. Look for drips underneath car afterwards. Gauge braking distances at high and low speeds.

- Verify title brand matches condition. Make sure the type of damage aligns with actual repairs done. A flooded car should have electrical repairs for example.

- Compare pricing/value against similar clean title cars. Is the discount deep enough given potentially thousands in future repair rework costs that may arise? This is especially important for sports cars and luxury vehicles where future repair costs are higher than you may think.

- Inquire about any repair warranties or guarantees. Some rebuilders offer short-term warranties on work done. See if anything transfers to new owner.

- History of the Chevrolet SSR: The Retro-Styled Convertible Pickup - Apr 25, 2024

- The History of the BMW M Coupe (the “Clown Shoe”) - Mar 26, 2024

- The History of the Ford Flex - Feb 28, 2024